Strategy | UI/UX | Web App

SME Smart Score

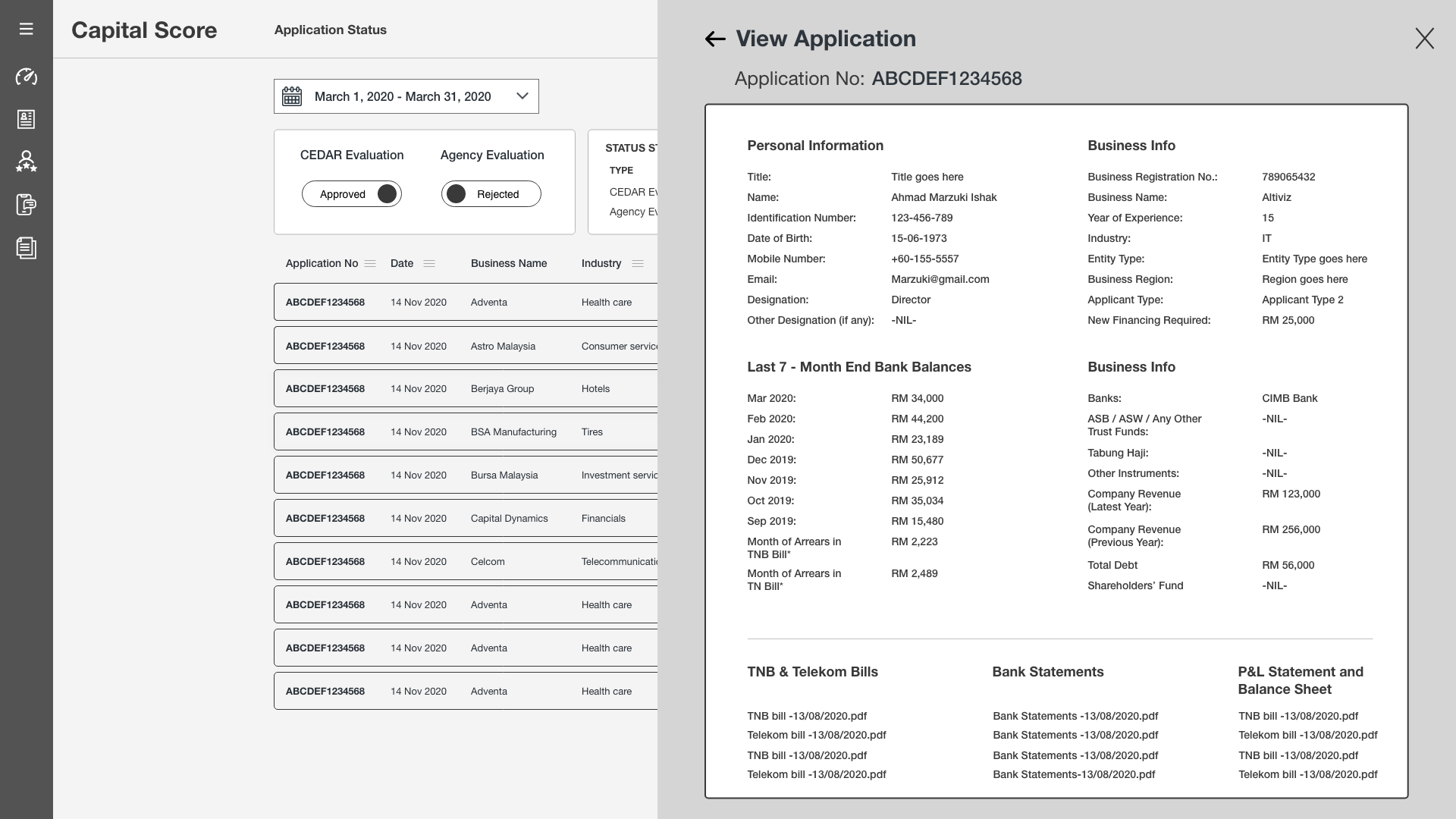

Loan Application Management System

The SME Smart Score Loan Application System is a digital platform designed to streamline and automate the lending process for Small and Medium Enterprises (SMEs). Unlike traditional lending that relies heavily on manual assessment and collateral, this system utilizes a “Smart Score” algorithm—a composite rating based on personal credit, business cash flow, and sector performance—to offer rapid, data-driven loan approvals.

Project Overview

Captial Score is SME Smart Score LMS (Loan Management System) Domain: Fintech / Banking / SME Lending Core Objective: To develop an end-to-end digital lending platform that automates the processing of Small and Medium Enterprise (SME) loan applications using a standardized, data-driven “Smart Score” algorithm to assess creditworthiness rapidly and accurately.

Design

Strategy

Client

Skoruz Solutions

Problem Statement

Core Issue: Traditional lending for Small and Medium Enterprises (SMEs) is manual, fragmented, and notoriously slow. Unlike salaried individuals with fixed income, SMEs have complex financial footprints that banks struggle to assess efficiently using legacy methods.

Key Pain Points:

- High Turnaround Time (TAT): Manual collection and analysis of documents (IT returns, GST data, bank statements) leads to processing times of 3–5 weeks.

- Subjective Underwriting: Loan officers often rely on “gut feeling” or limited data, leading to inconsistent decisions and human bias.

Data Silos: Critical data (Credit Bureau, Banking, Tax) lives in disconnected systems, making it difficult to get a holistic 360-degree view of the borrower’s health.

Lack of Transparency: Applicants are often left in the dark regarding their application status, leading to poor customer experience and high drop-off rates.

A Data-Driven, Automated Lending Ecosystem

Core Concept: The SME Smart Score LMS is a unified web application that digitizes the entire loan lifecycle—from origination to sanction. It replaces manual underwriting with a proprietary “Smart Score” algorithm, enabling data-backed decisions in minutes, not weeks.

Key Features & Fixes:

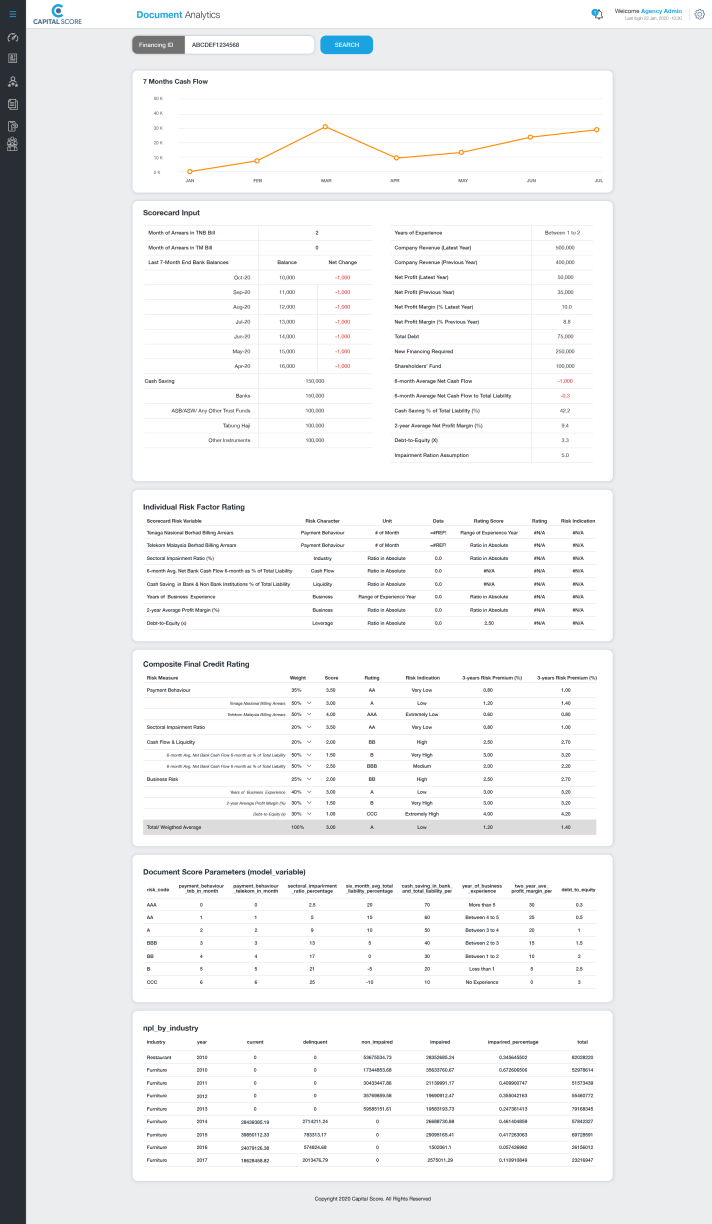

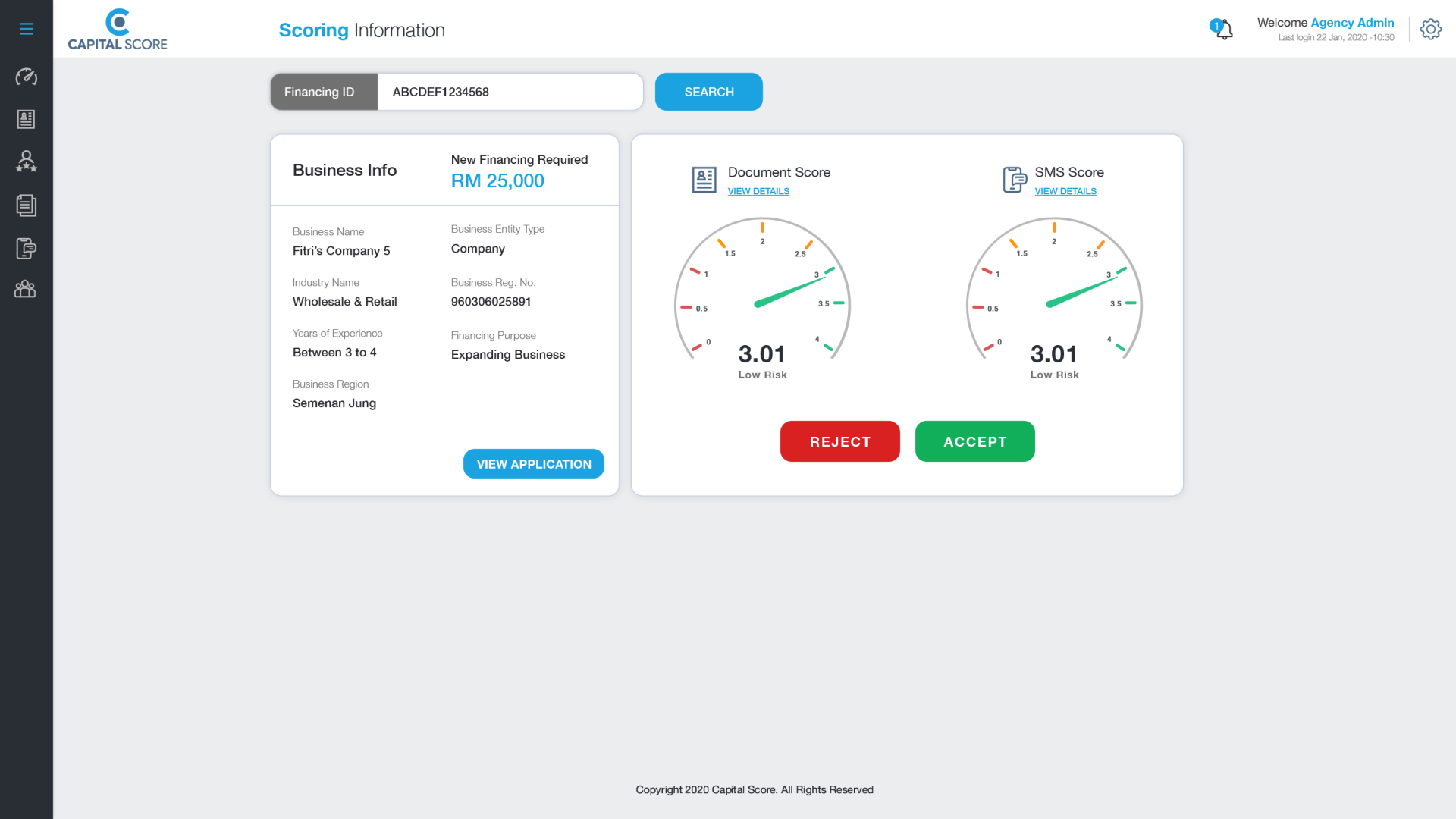

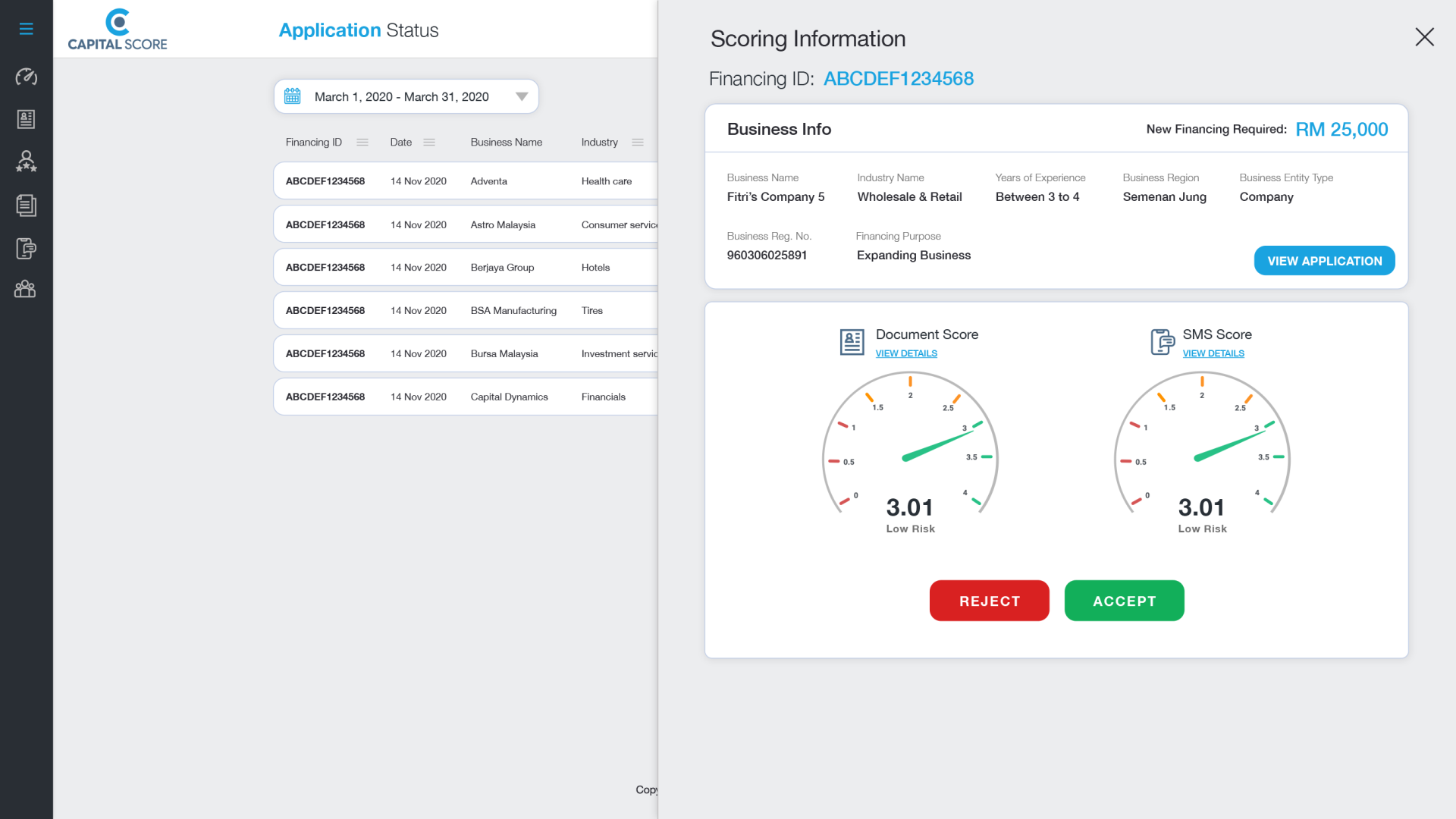

- The “Smart Score” Engine:

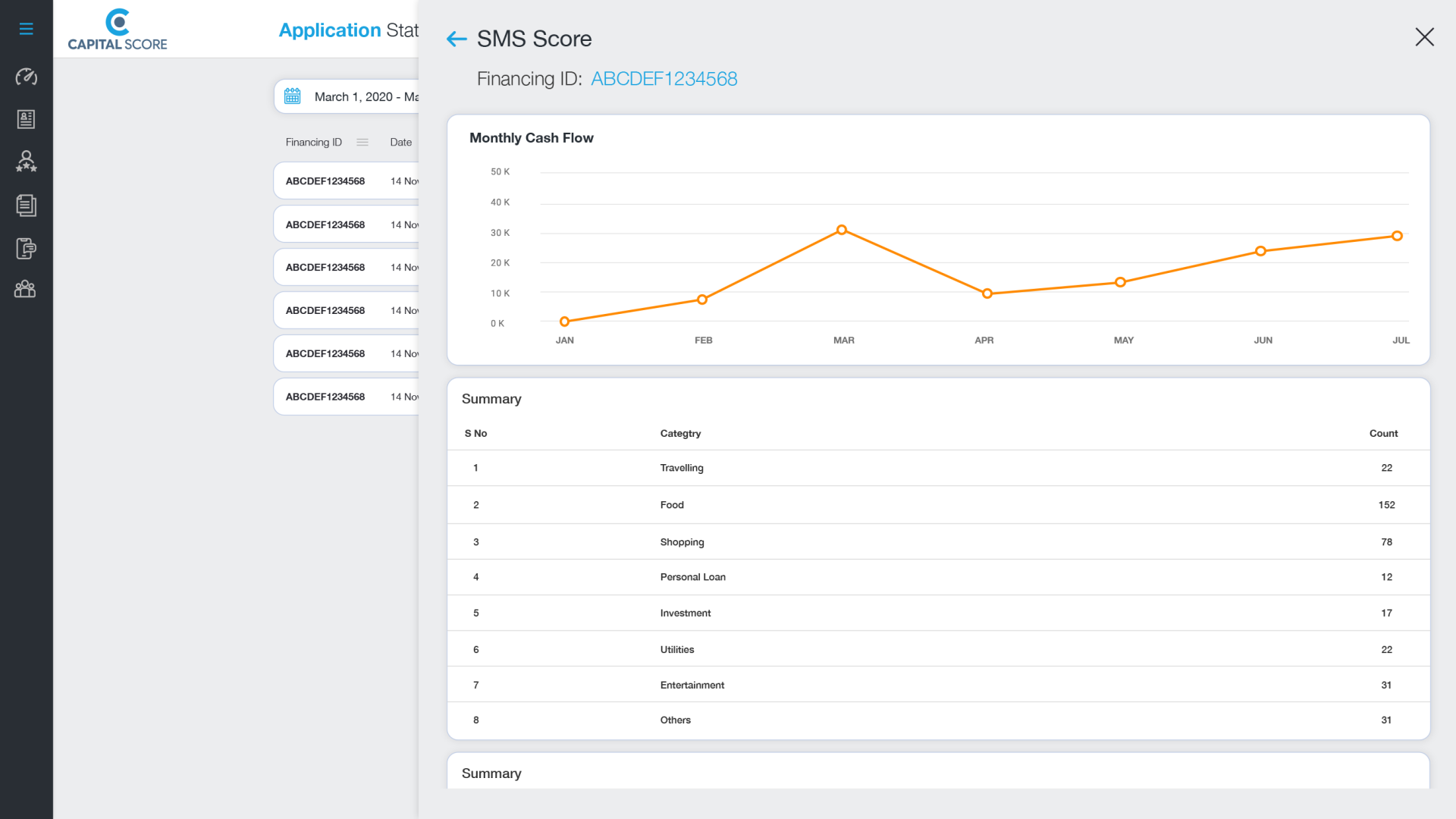

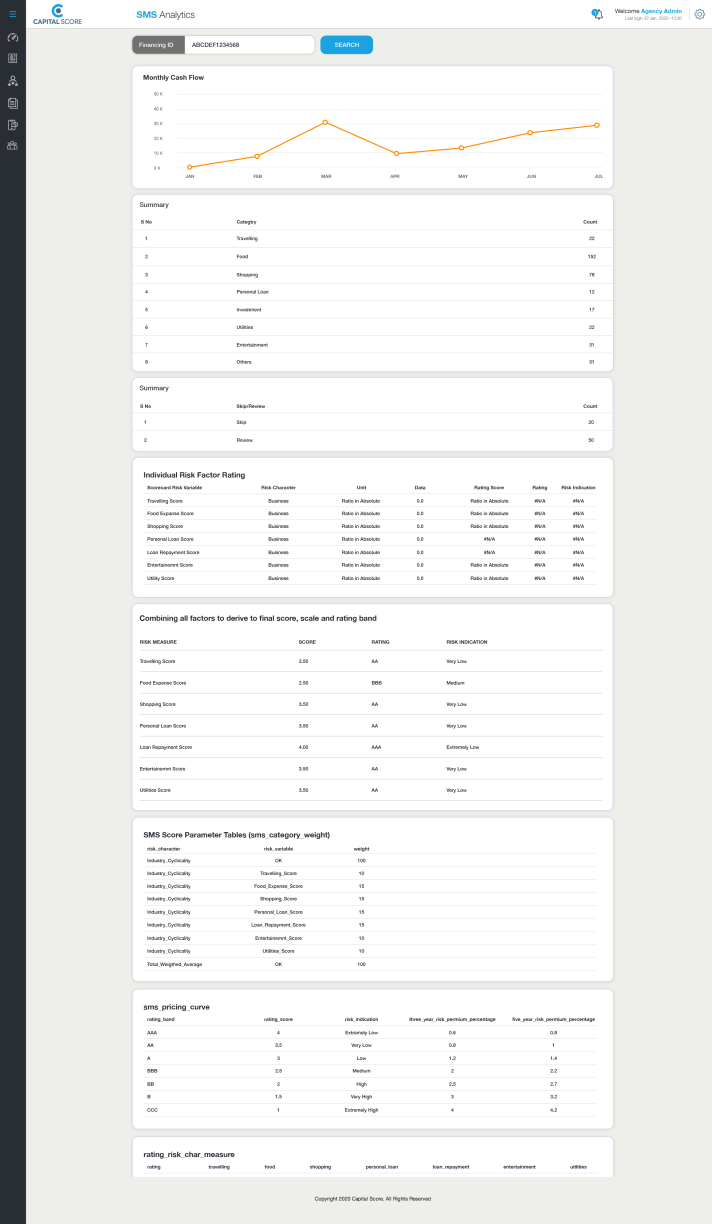

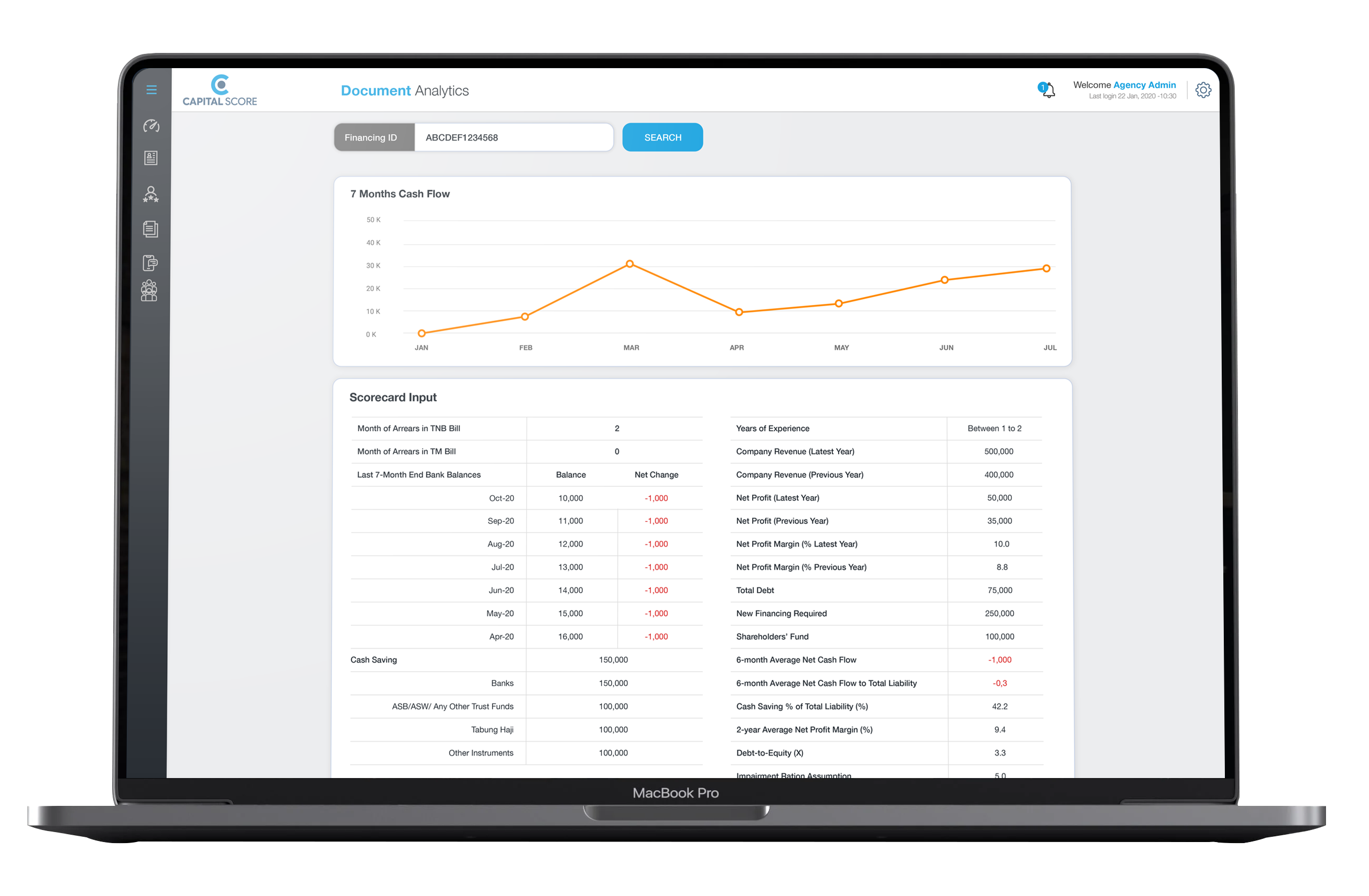

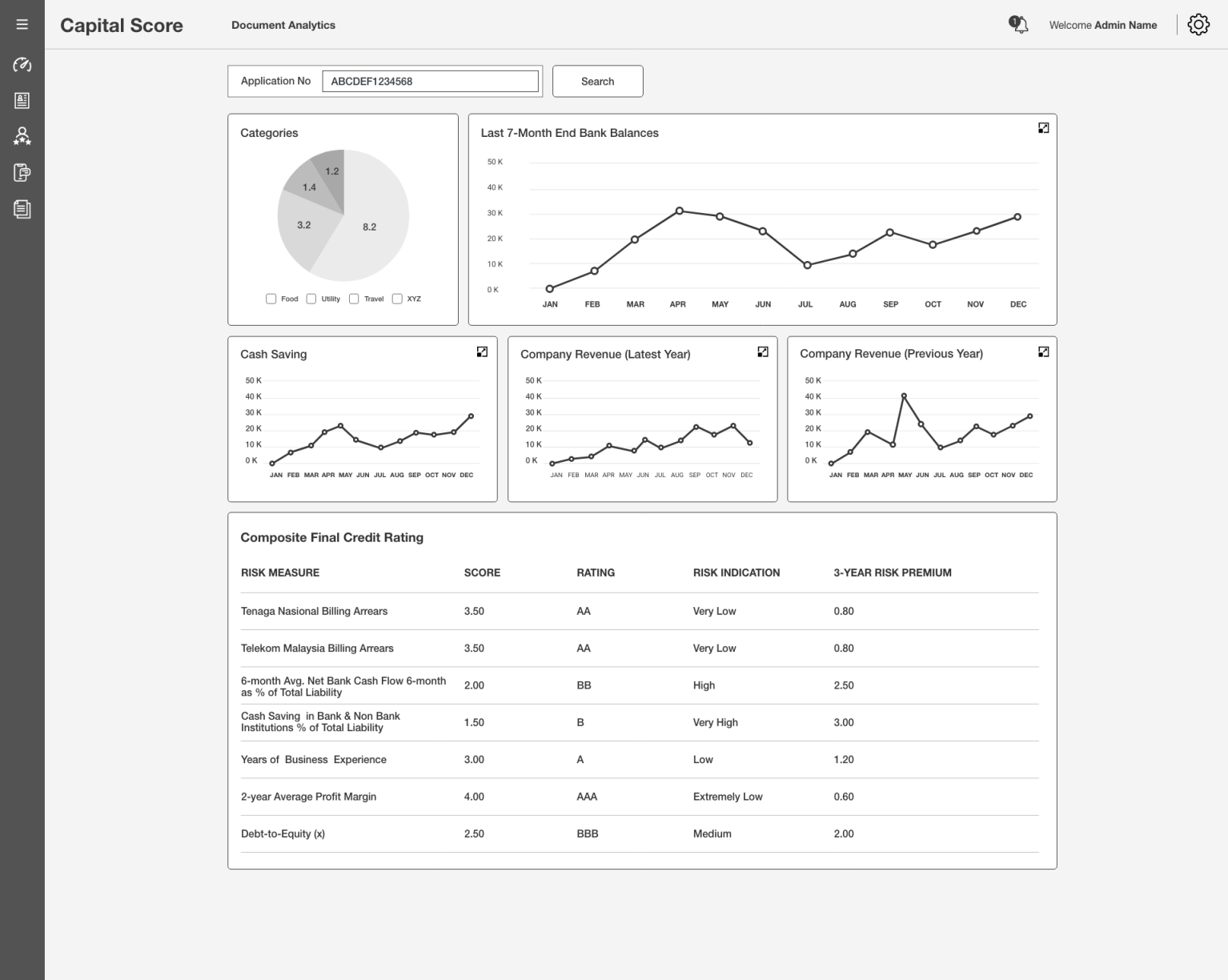

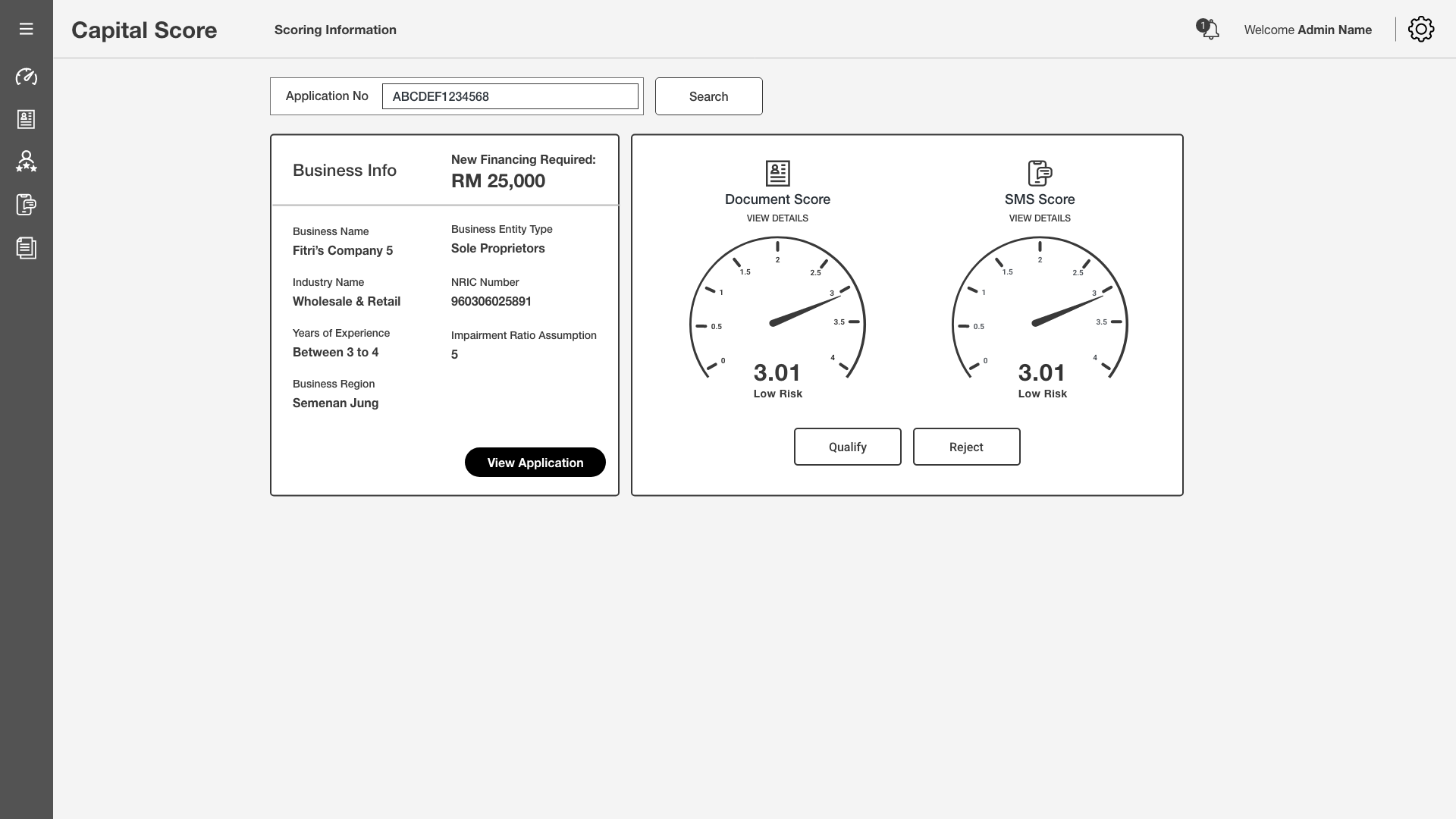

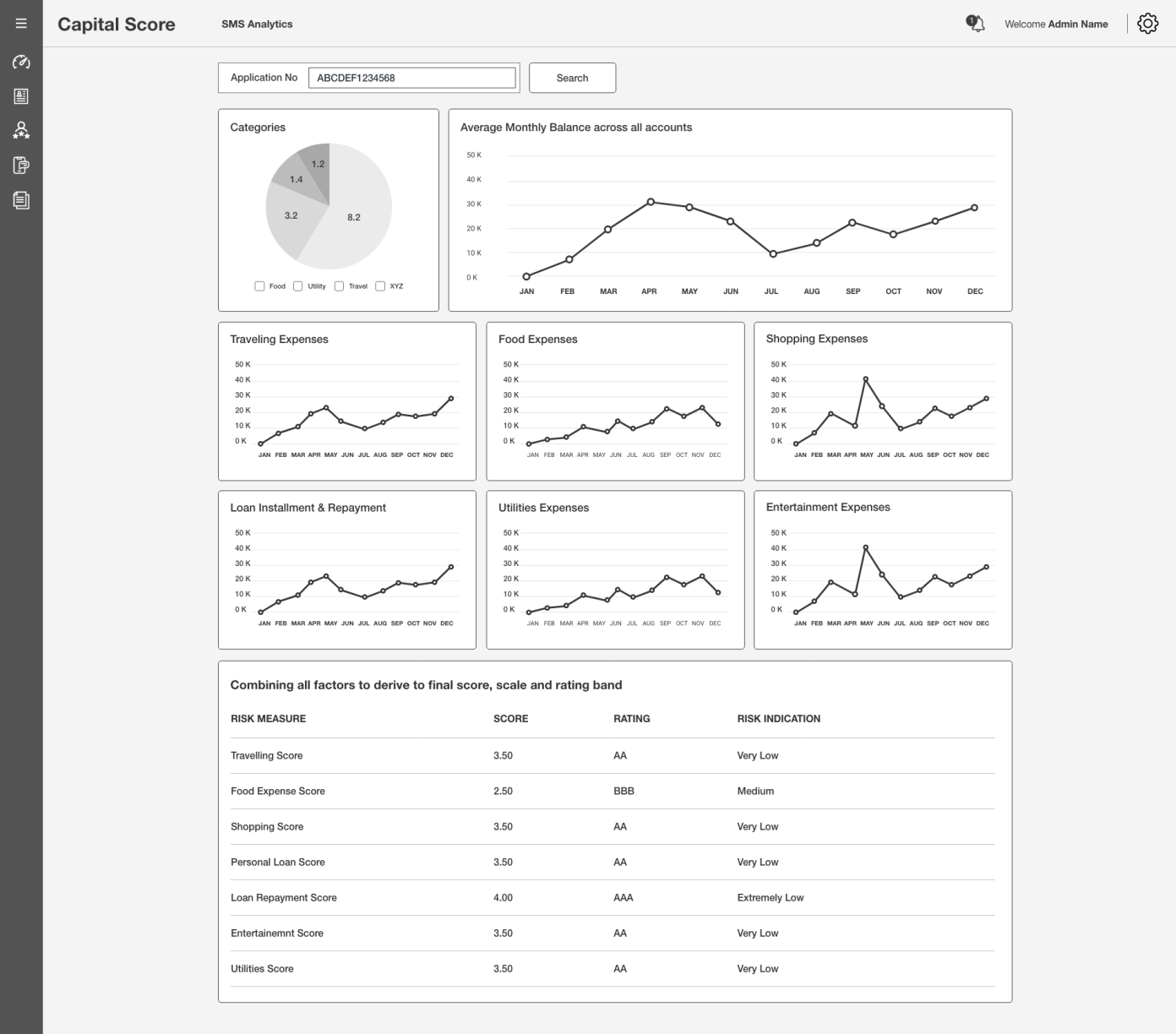

- Solution: An automated scoring model that aggregates data from 4 pillars (Promoter Profile, Business Financials, Banking Habits, and Collateral) to generate a single creditworthiness score (0–100).

- Impact: Removes subjectivity and standardizes risk assessment.

- API-First Integration:

- Solution: Direct integration with CIBIL, GSTN, and Bank Statement Analyzers.

- Impact: Eliminates manual data entry and reduces fraud risk by fetching verified data directly from the source.

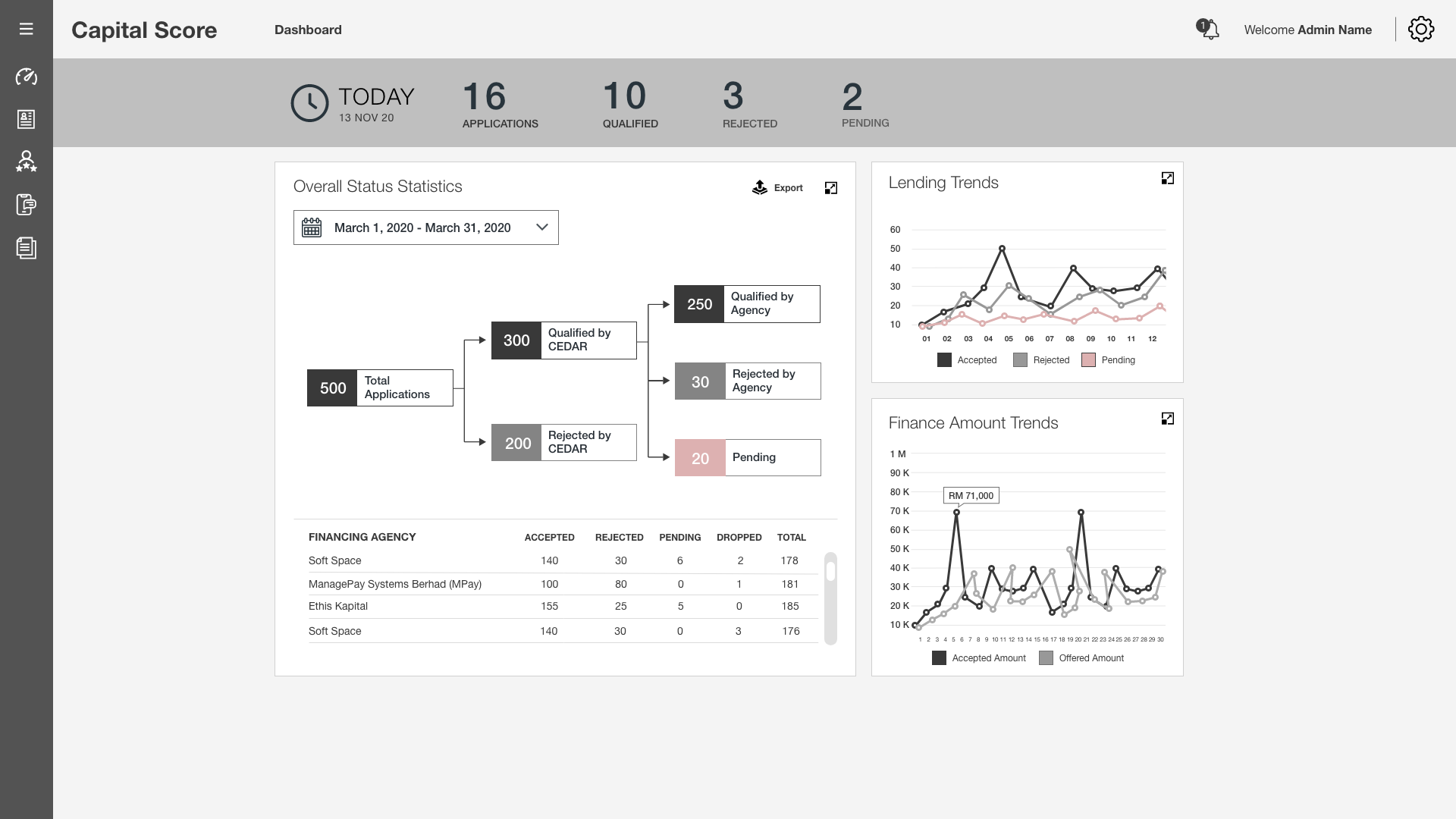

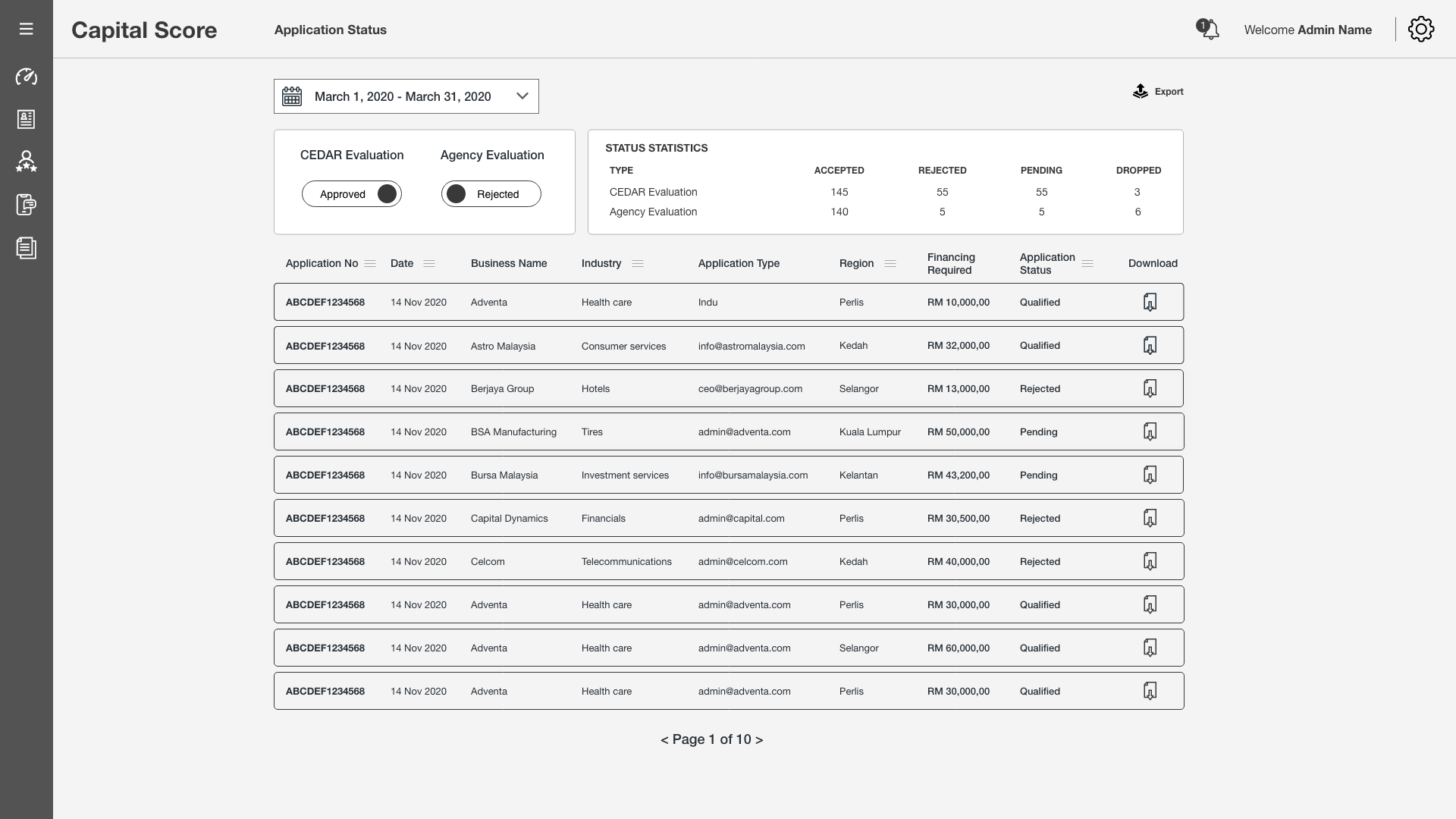

- Role-Based Dashboards:

- Borrower View: A clean, progress-tracked interface to upload docs and view “Smart Score” status.

- Banker View: A prioritized queue highlighting “Green Channel” (Auto-Approve) vs. “Amber Channel” (Review Needed) applications.

- Impact: Streamlines workflow and focuses human effort only where needed.

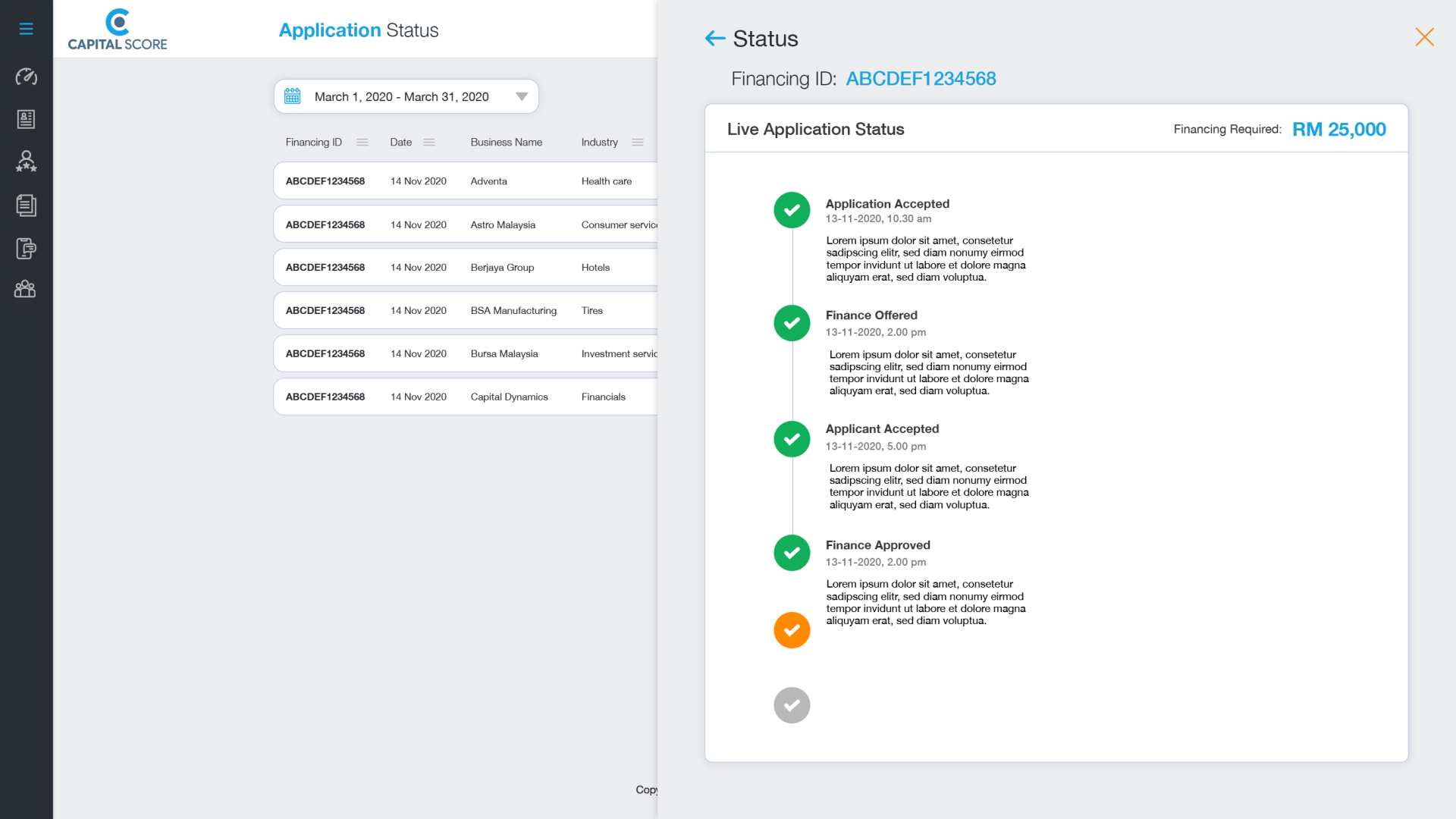

- Real-Time Status Tracking:

- Solution: A transparent timeline showing exactly where the application sits (e.g., “Verification in Progress,” “Pending Sanction”).

- Impact: Increases borrower trust and reduces support calls.

The Users and the Industry

The SME sector is often called the “Missing Middle” in banking. They are too big for microfinance (small personal loans) but too small and informal for corporate banking (large, structured loans).

The Core Industry Problem:

- High Cost of Operation: It costs a bank almost the same amount of administrative effort to process a $10,000 loan as it does a $1,000,000 loan. This makes small SME loans unprofitable under manual processes.

Information Asymmetry: SMEs often run on “Kachha” (informal) books. They might have healthy cash flow but poor filed tax returns. Traditional banks look at tax returns and reject them; the Smart Score system needs to look at cash flow (banking habits) to approve them.

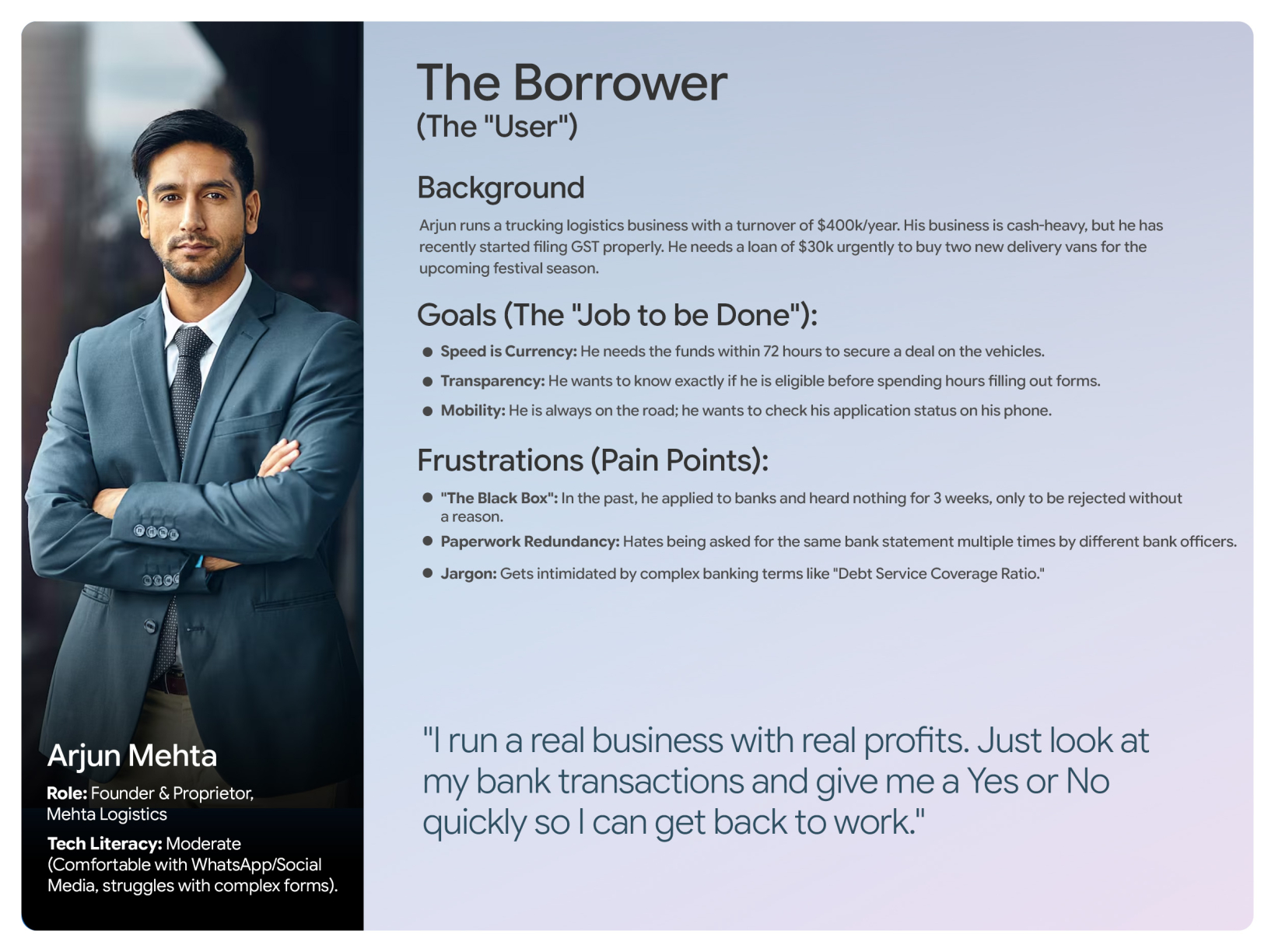

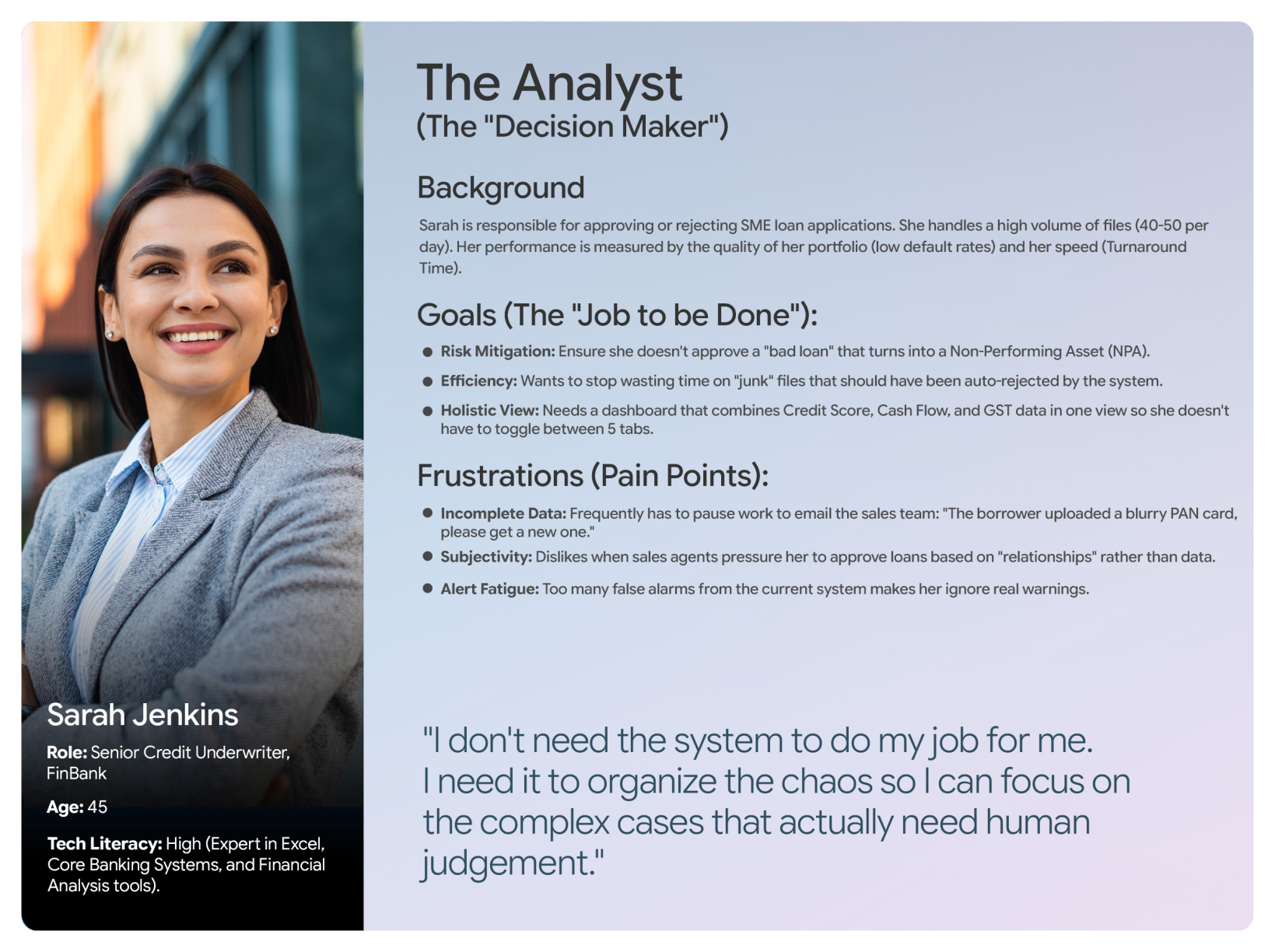

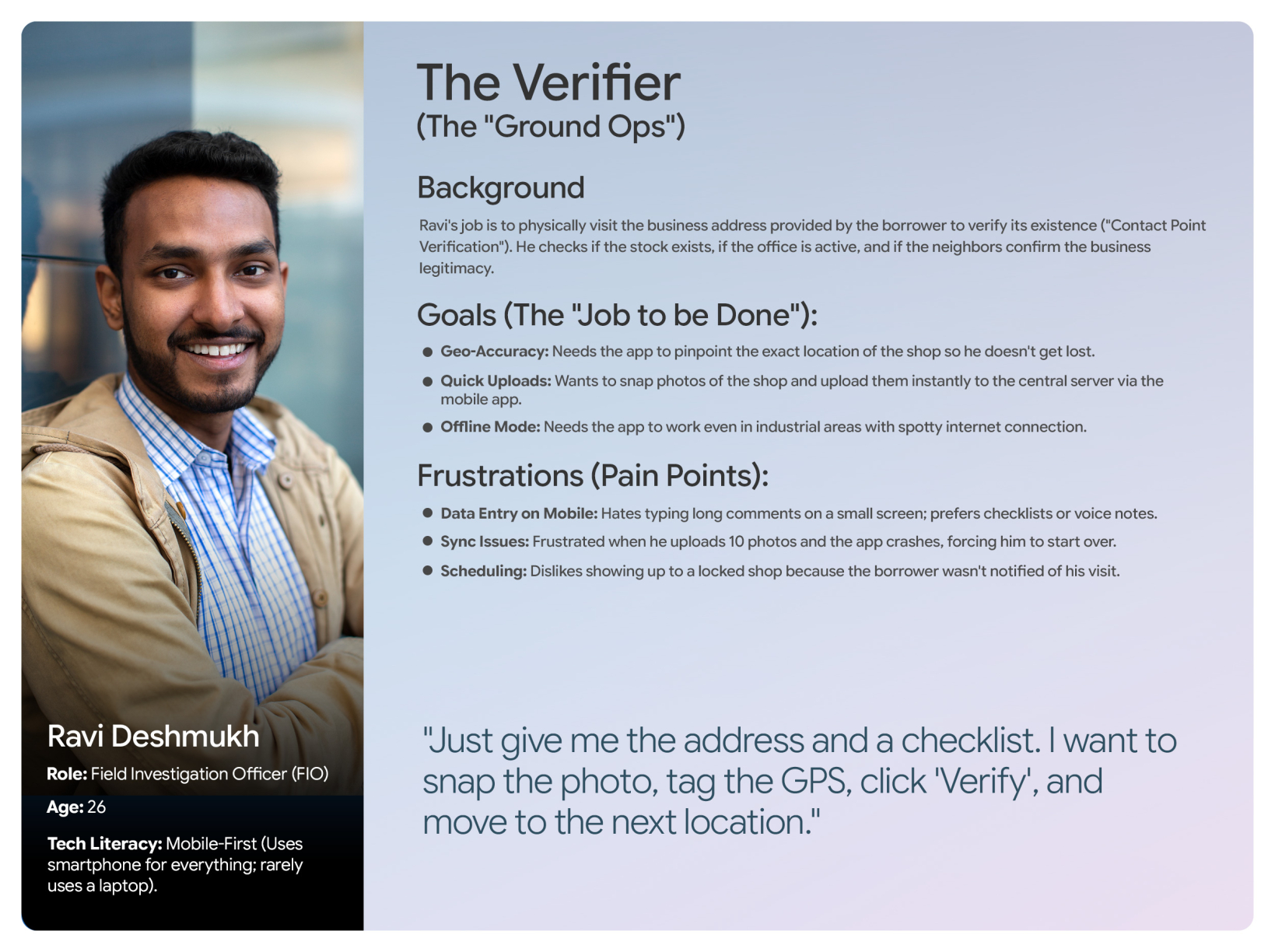

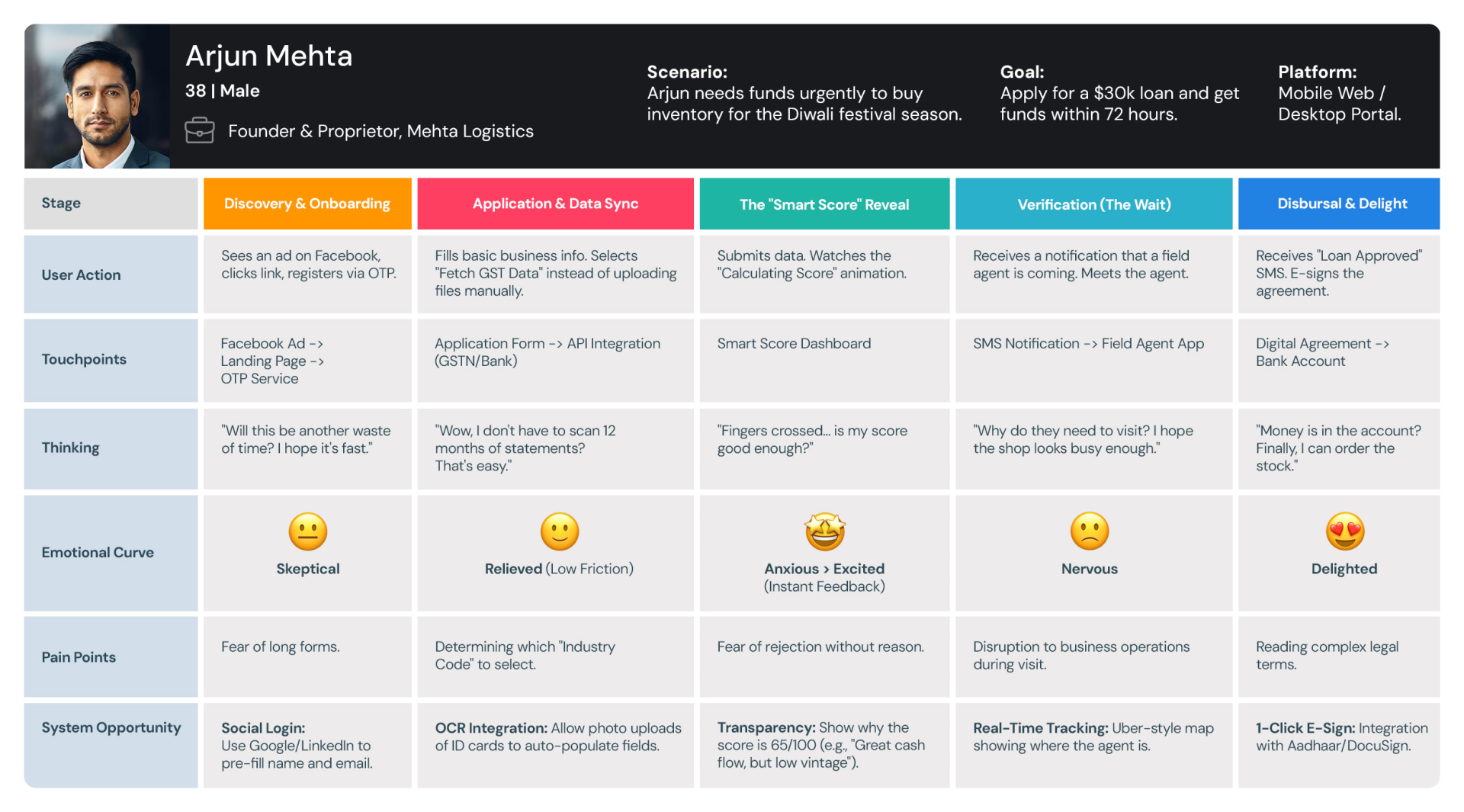

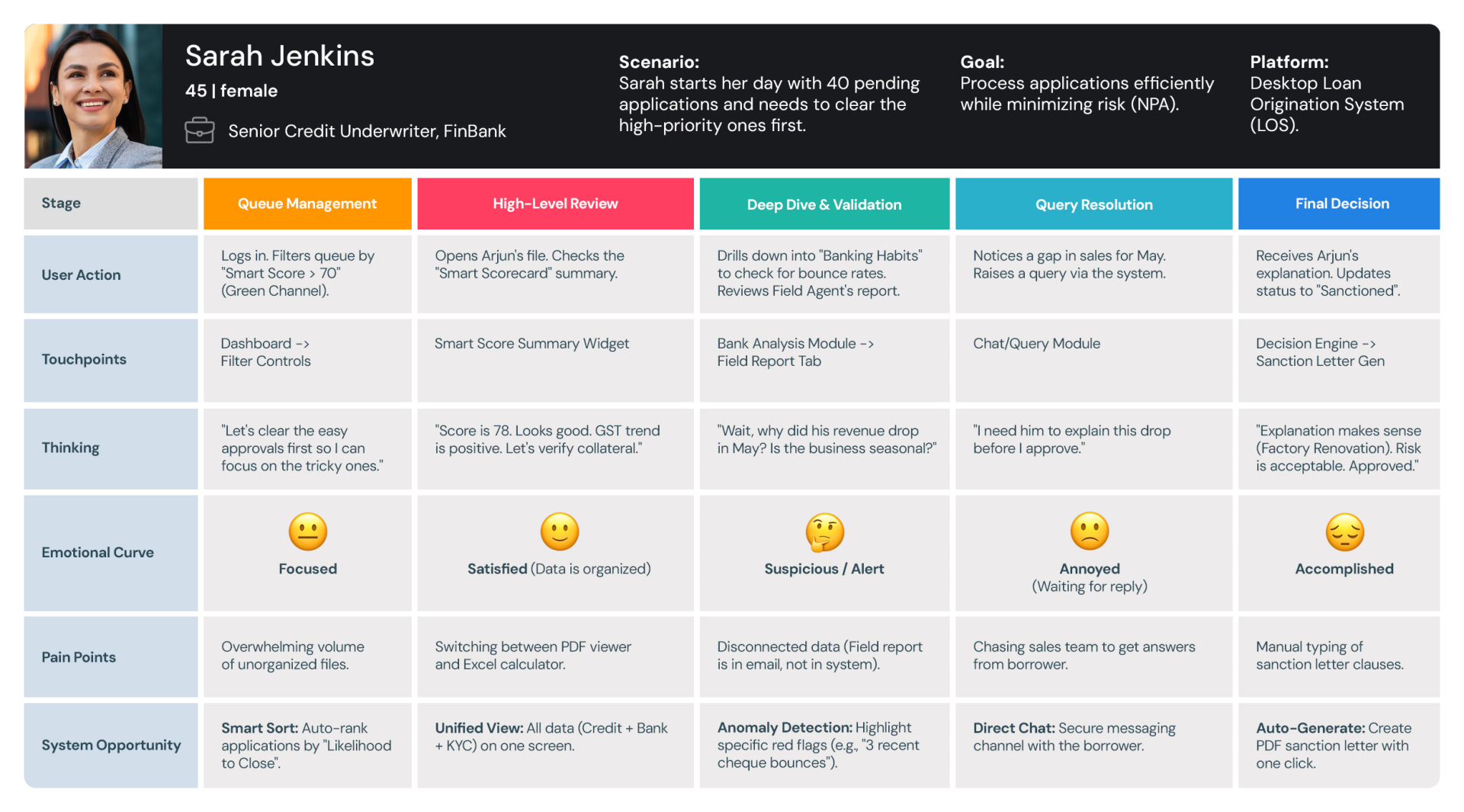

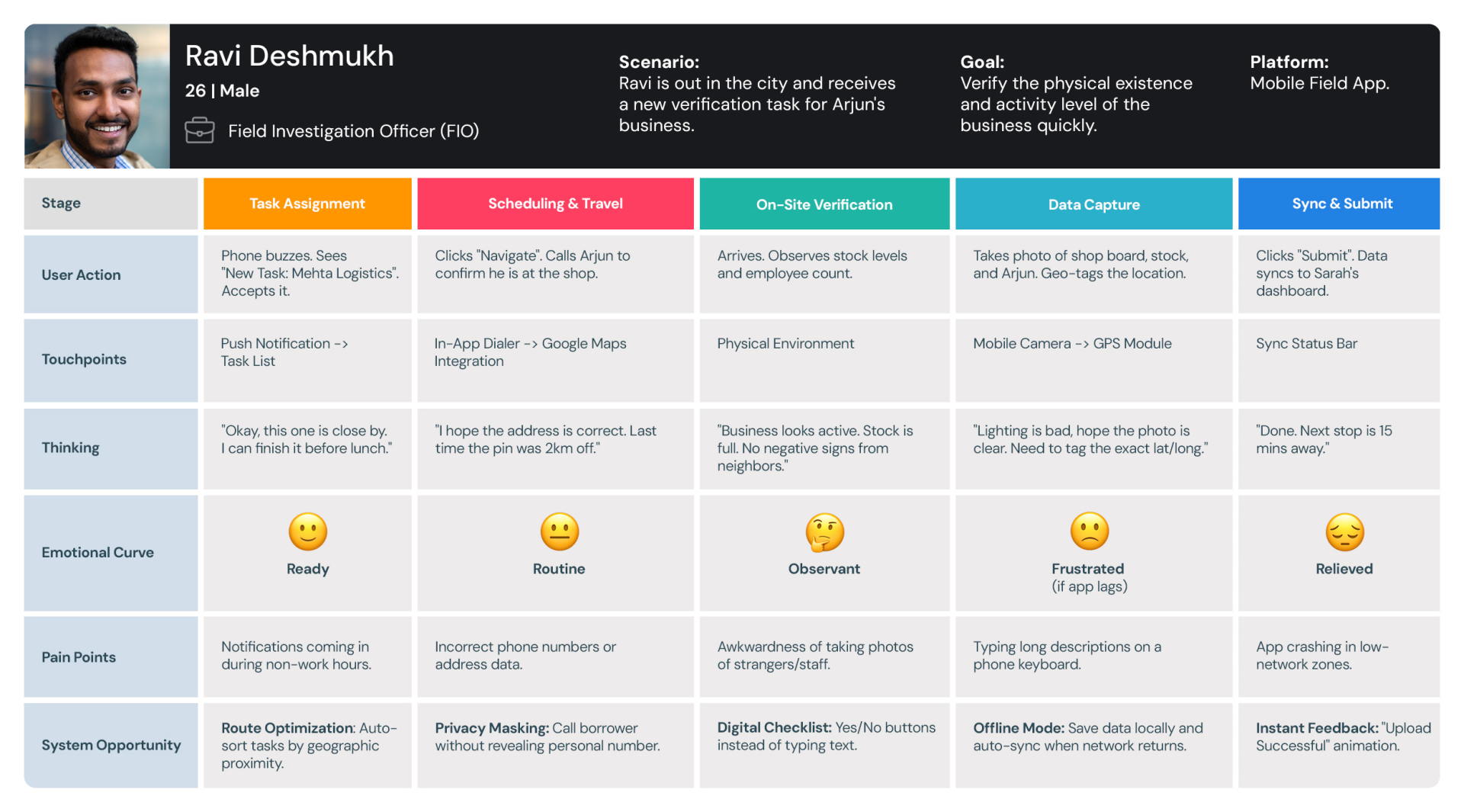

Personas

& User Journey Maps

My interviews with the Business Users and Callers provided critical, detailed information. This foundation allowed me to successfully create the resulting personas and journey maps.

Personas

User Journey Maps

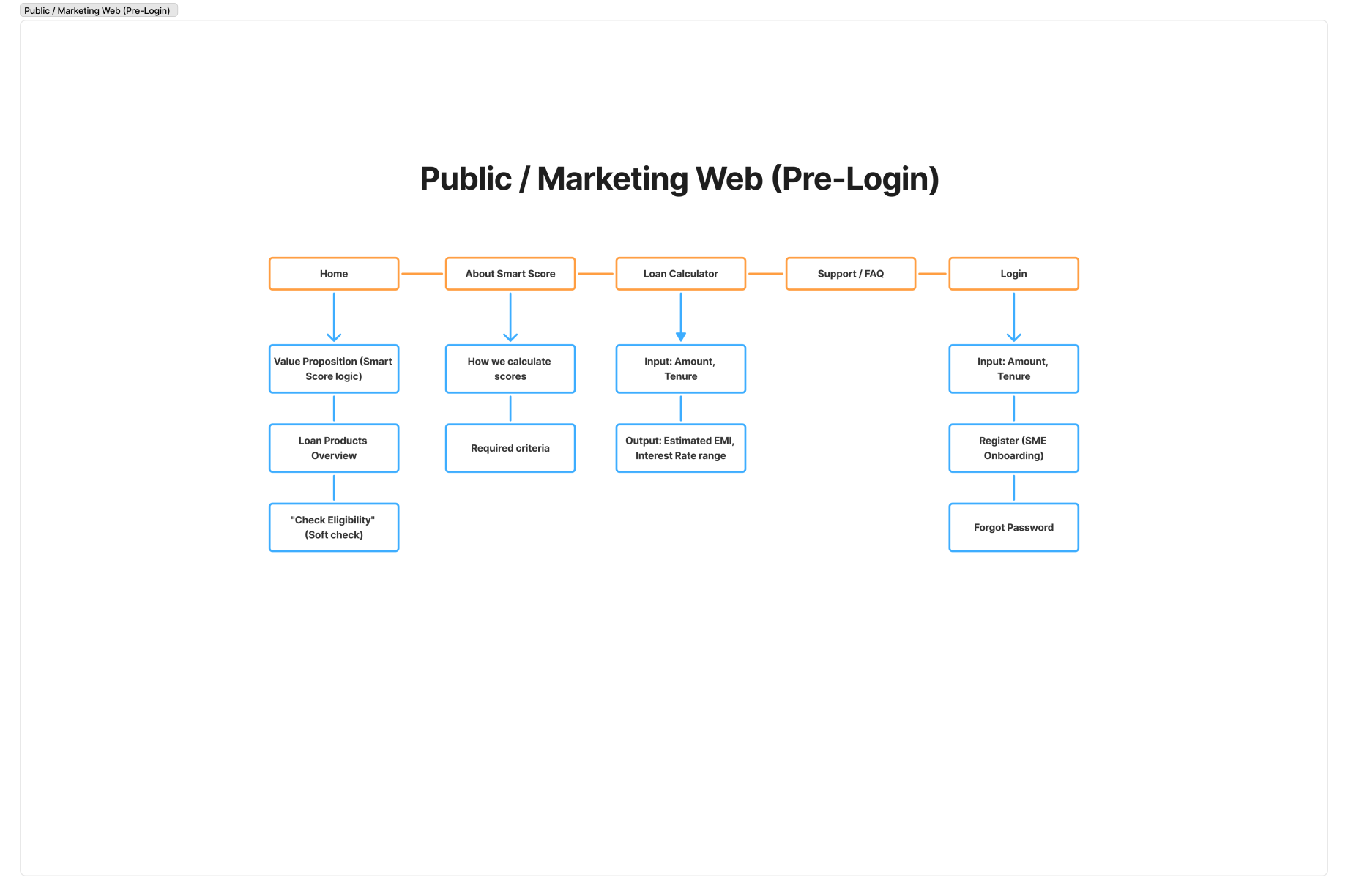

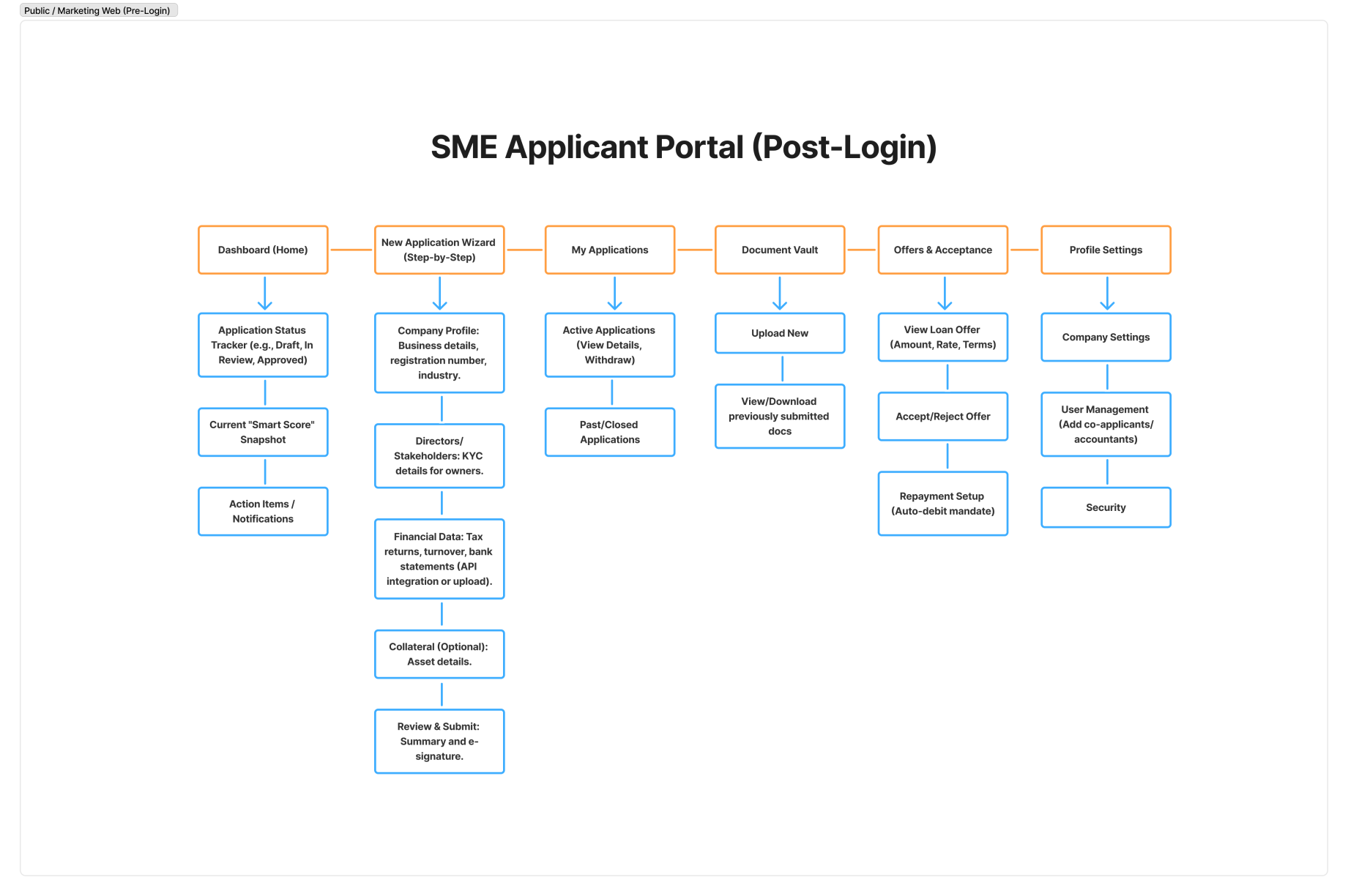

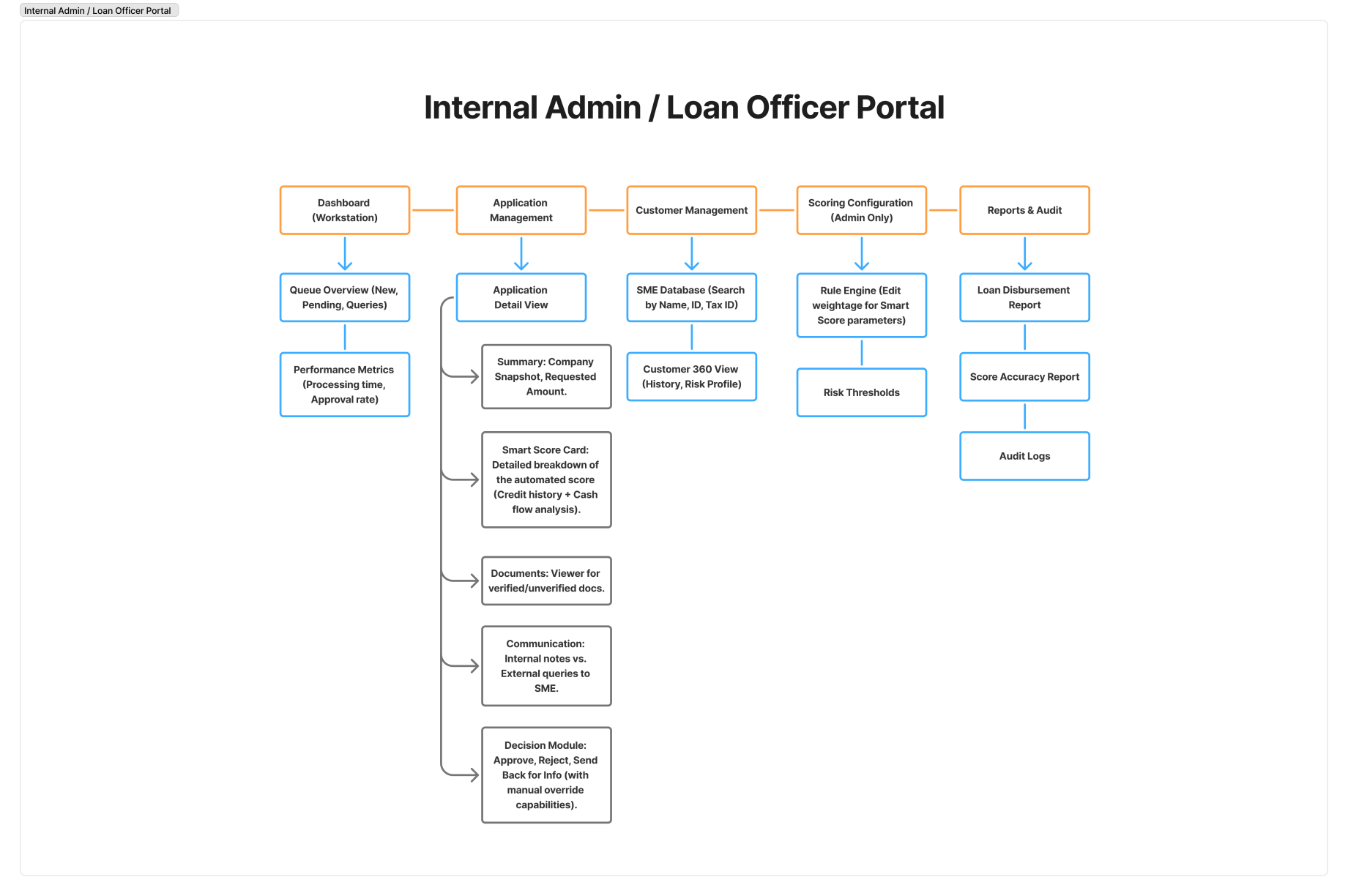

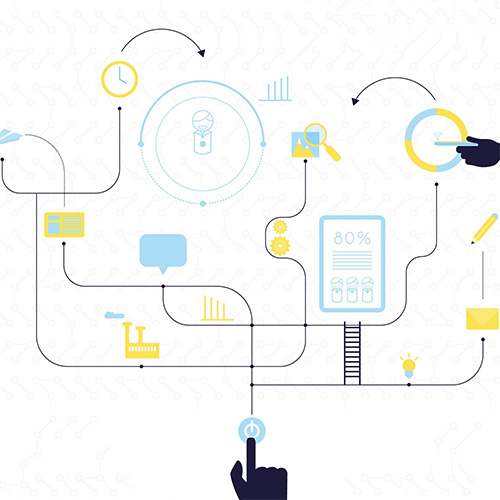

Information

Architecture.

Here is a comprehensive Information Architecture (IA) for the SME Smart Score Loan Application Management System.

This structure is designed to support two distinct user journeys: the SME Applicant (seeking a loan) and the Bank/Loan Officer (processing the application and managing the “Smart Score”).

User Roles & Access Levels:

- Public User: Unregistered SME owner exploring options.

- SME Applicant: Registered user applying for a loan and tracking status.

- Loan Officer / Underwriter: Internal staff reviewing applications and scores.

- System Admin: Manages configurations, scoring algorithms, and user access.

Wireframing

Our internal process challenges eventually surfaced in our design output. In just two months, we generated over 200 artboards in a high-speed sprint to meet deadlines. However, the volume came at a cost: documentation suffered, and many screens were unintentional replicates. It was a powerful lesson in how ‘moving fast’ can sometimes get in the way of ‘moving right.

Style Guide